The Super Crowd, Inc. Story

-

Annual Virtual Events. In 2022, Devin Thorpe, the founder and CEO of TSCI, along with 25 co-host companies and organizations, successfully hosted the inaugural SuperCrowd22 event. SuperCrowd23 is scheduled for May 10-11, 2023. Dozens of speakers and more than a dozen co-hosts have already committed to participate. The annual SuperCrowdXX events feature:

- Expert keynote addresses

- Training workshops for in-depth learning

- Panel discussions of critical issues

- Networking sessions

- Live pitch sessions in partnership with a nonprofit

- Local Popup Events. Beginning in 2023, TSCI will host local events in cities and towns across the country. Shareholders will participate in choosing locations. Designed for 50 to 100 participants, popup events will feature expert training, including some provided by Devin Thorpe.

- Virtual Monthly Sessions. The virtual monthly sessions may include training, expert interviews or live pitch sessions in partnership with a nonprofit.

The Founders

Devin D. Thorpe

CEO

Devin calls himself a champion of social good. After a 25-year finance career, Devin shifted his focus to solving the world's biggest problems. His favorite tool is investment crowdfunding.

The Team

Bill Huston

Advisor

An advisor to TSCI, Bill Huston is an Inc Magazine Top 19 Global Crowdfunding Expert who has managed or consulted on 6 investment crowdfunding campaigns that have raised over $700,000 since 2021. Bill was a content consultant for the Rutgers University Crowdfunding With Impact program and a board member of The National Coalition for Community Capital, and a founding member of the Black Crowdfunding Coalition along with the 10K Project and Crowd Wall Street.

Jackie Logan

Advisor

An advisor to TSCI, Jackie is a co-founder and CIO at Raise Green. She has 25 years of experience in the capital markets having had roles in institutional sales on the trading floor to compliance in Private Wealth. In her last role at Goldman Sachs, while working with product teams developing ESG investment strategies, she realized that we need significant private capital moving into direct climate solutions, and now! Ratings and rankings just did not have the consistent and granular data to effect the needed impact. During Climate Week NYC 2019 - she happened to meet her fellow co-founders by chance. Very quickly, she knew Raise Green offered a solution and joined Raise Green to make this happen and never looked back. Jackie is a New York City native, has a BA degree from Williams College in Chemistry, and graduated with Honors from The Wharton School with an MBA.

Peter Rostovsky

Advisor

An advisor to TSCI, Peter was the Crowdfunding Professional Association Secretary of the Board of Directors; he spearheaded the 2021 annual summit. Peter’s background focuses on business development for capital markets intelligence services. He advises service providers & issuers in the crowdfunding industry on product strategy and marketing.

Added 11 months ago

SuperCrowd23 was a huge success. For investors, nothing matters more than the financial outcomes, so let me start there. Revenue grew 65% over 2022! That's huge progress. Before overhead, the event was solidly profitable. We're successfully proving the model.

We had over 100 people on the program!

We delivered 25 breakout sessions!

Experts presented 14 different workshops.

We had 13 panel discussions, including an 11-member CEO panel moderated by Crowdfund Main Street CEO Michelle Thimesch.

Twelve people won microgrants.

Ten companies pitched at SuperCrowd23.

We delivered four general sessions.

Three experts grilled the entrepreneurs who pitched.

We presented two SuperCrowd23 Impact Crowdfunder of the Year Awards, one to Aptera and the other to World Tree.

We featured two hours of virtual trade show sessions.

We enjoyed an hour of VIP networking.

Overall, the event was a huge success.

Added 11 months ago

Hi Devin, this is great to hear and glad I could catch your pitch during the Angels of Mainstreet gathering the other day. One thing I'm still not clear on is what the potential financial return to investors could look like? Is it in the form of dividends, do you see TSCI being acquired down the road, etc?

Also, I would be interested in backing the campaign using my self-directed IRA, but that would require you to set up an account with them. I use AltoIRA. Let me know if you would be open to that, and glad to discuss offline, too.

Added 11 months ago

Chuck, thanks for following up on the Angels of Main Street pitch. I was dealing with peak covid that day, so I'm thrilled to hear I was coherent enough to garner your interest.

You've asked great questions. Let me tackle them one at a time:

"...what the potential financial return to investors could look like? Is it in the form of dividends, do you see TSCI being acquired down the road, etc?"

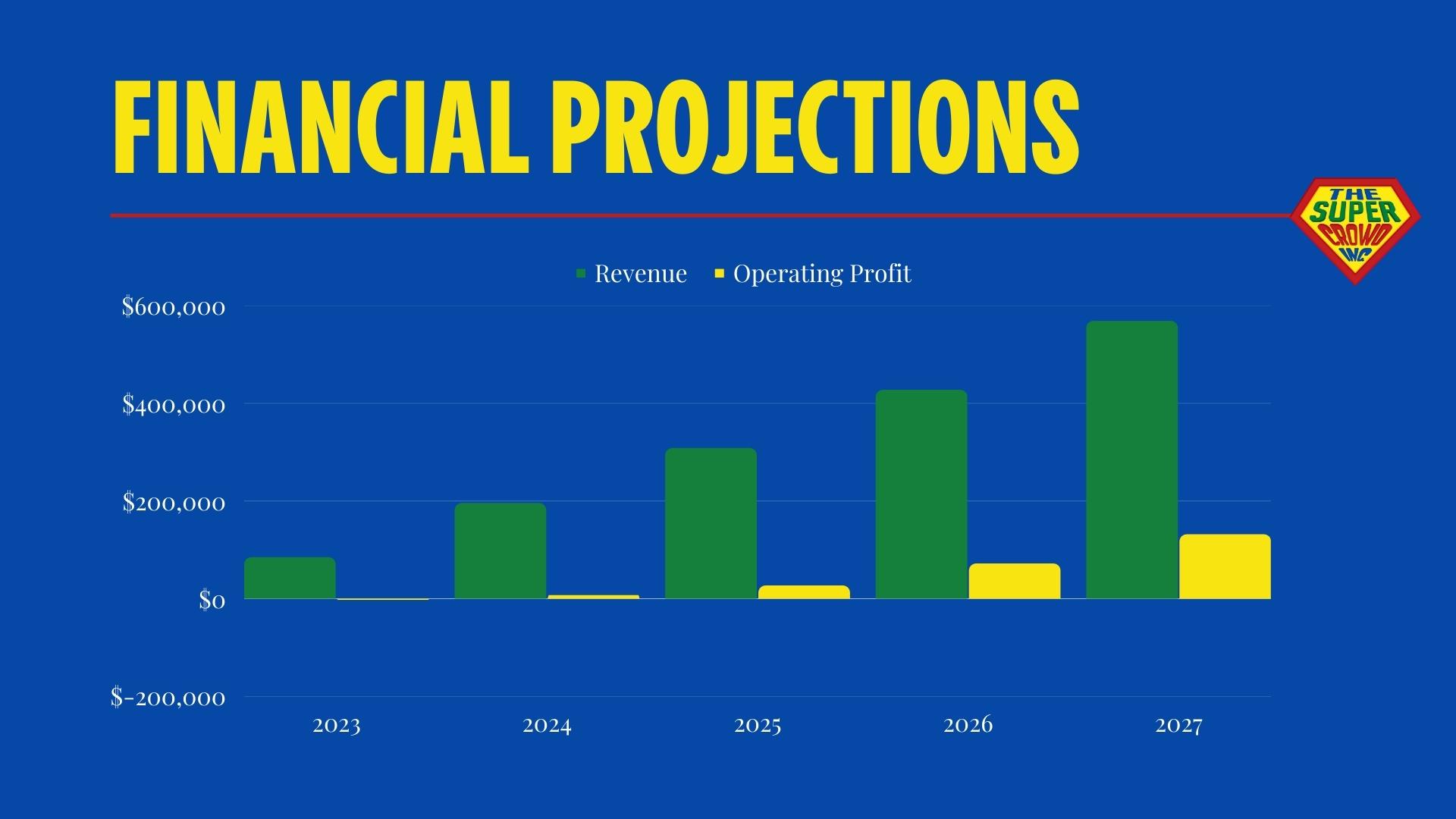

We have plans to grow the business tenfold from 2023 levels over the next five years. We can continue growing thereafter. We'll strive to be profitable in 2024, allowing us to begin paying dividends. We intend to grow the dividend payments parallel with the growth of profits. Note that my compensation will be those same dividends, paid on a pro-rata basis. So, for me to earn $50,000 of dividend income, I'll have to pay $2 per share in dividends. That's a big incentive for me to drive the growth of profits.

Ultimately, we'll build a team of people who help to plan and organize events and who develop relationships with the network of people I know and call upon as experts. That team will represent a going concern that can be sold to another player in the industry. Note that the pre-money valuation for this offering is just $300,000. That means that even after allowing for the dilution associated with this offering if we sell the business for $1 million, we'd have tripled the value of the business--on top of paying dividends.

"Also, I would be interested in backing the campaign using my self-directed IRA, but that would require you to set up an account with them. I use AltoIRA. Let me know if you would be open to that, and glad to discuss offline, too."

As far as making an investment using your self-directed IRA account, that is absolutely possible! The question you have about creating an account with them should be directed to Crowdfund Main Street. I will make sure they get in touch with you. I believe you know Michelle and how to get in touch with her. Reply here if that isn't the case, and we'll make sure you two connect.

Again, thanks for your interest, Chuck.

Added 11 months ago

Today, I shared a new podcast episode with my community. You can find it here:

https://devinthorpe.substack.com/p/assurely-offers-d-and-o-insurance#details.

In this podcast with David Carpentier, CEO of Assurely, a venture-backed insurance company, we discussed the company's new product called Tiger Mark. This is insurance for crowdfunding offerings. I'm happy to say that I purchased this coverage for this offering! As an investor, you are covered against losses from fraud.